According to AMD, Intel, and the South Korean trade ministry, sales of processors and memory for client PCs are dropping faster and more significantly than expected. Media reports say that shipments of memory were down nearly 25 percent last month because of softening demand in Europe and the U.S., as well as lockdowns in China.

Just a little less than a month ago, IDC said that shipments of PCs will drop to 305.3 million units in 2022, down 12.8% from 348.8 million units in 2021. The revised PC shipments forecast for 2022 was primarily based on reports from PC makers and sales forecasts of companies like AMD and Intel. But the situation got worse than expected pretty quickly.

Earlier this year, Intel expected sales of PCs to drop around 10% year-over-year and start to rebound already in the second half of 2022. AMD was a little more pessimistic and forecasted the PC market to be down ‘midteens percent’ in 2022 compared to the previous year. But executives from both companies told Stacy Rasgon, an analyst with Bernstein, that the market was trending worse than expected, reports Barrons.

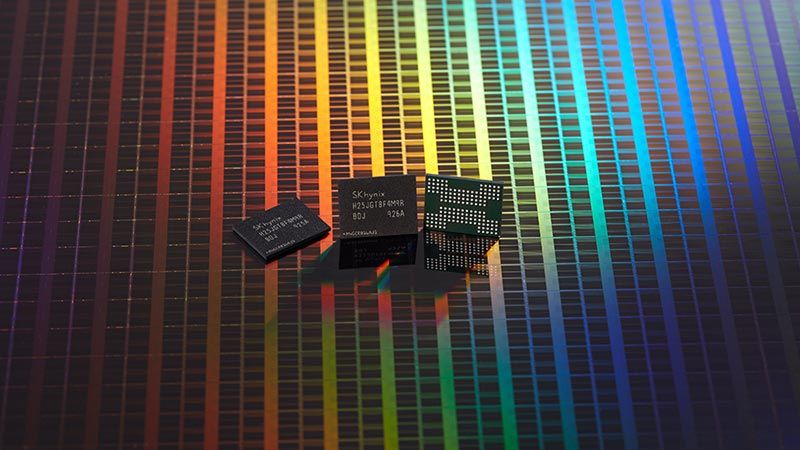

CPU sales are an important indicator of PC market health. The earnings of memory suppliers are another good indicator of what to expect from the PC market. Shipments of DRAM fell 24.7% in August compared to the same month a year ago because of lower demand for PCs in Europe and the U.S. and COVID lockdowns in China. By contrast, sales of South Korean DRAM in July dropped 7% YoY, reports DigiTimes citing data from Bloomberg and the South Korean trade ministry.

This is bad news for South Korea as the country’s tech exports account for one-third of the country’s exports. DRAM accounts for about half of Korean memory chip sales, and 3D NAND accounts for another half. In general, South Korean tech export dropped 4.6% year-over-year in August.

South Korea-based Samsung and SK Hynix control about two-thirds of the global 3D NAND and DRAM memory markets, so if they have problems selling their chips, it is a clear indicator that demand is dropping. What remains to be seen is whether the two companies will lower their 3D NAND and DRAM pricing or reduce output to keep prices at comfortable levels.

Memory price reductions could be good for the ongoing transitions to DDR5 memory and for costs of SSDs featuring a PCIe 4.0 x4 and PCIe 5.0 x4 interfaces. But this will affect the abilities of companies like Samsung, SK Hynix, and Micron to invest in future products and process technology transitions, which is not particularly good for the long-term.