AMD continues to grow despite supply constraints.

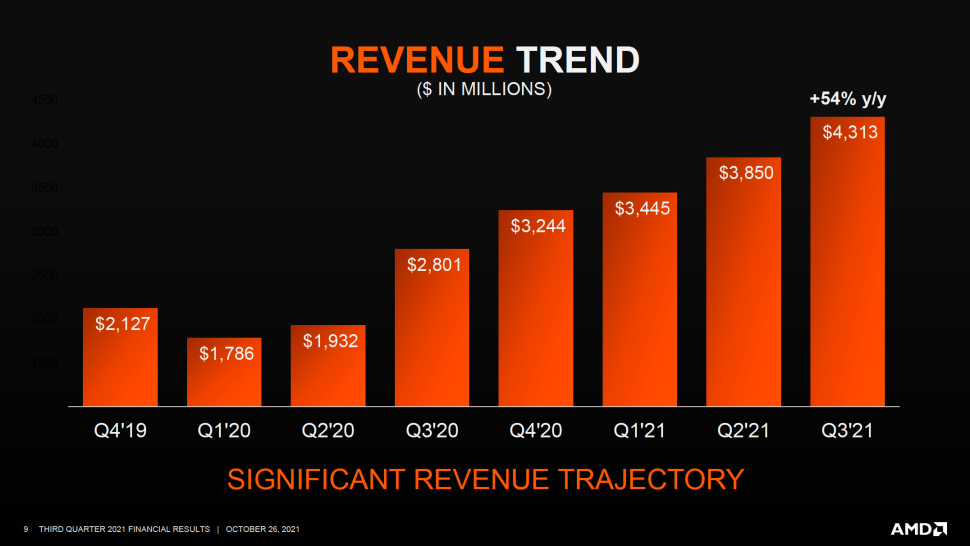

Owing to its very strong lineup of client and server CPUs as well as booming demand for PCs and servers, AMD has been posting a 50% year-over-year revenue growth for five consecutive quarters. In the third quarter of the company’s fiscal 2021, AMD was in a particularly good shape as it managed to increase supply of its latest products that are in high demand. As a result, the company posted its new all-time record revenue.

Another Record Quarter

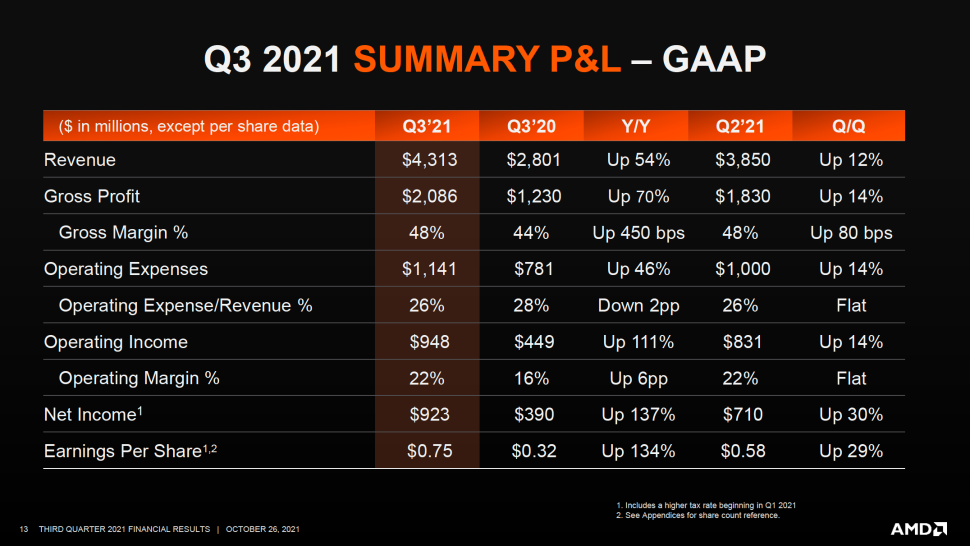

In the quarter that ended September 25, 2021, AMD earned $4.313 billion (up 54% year-over-year), which is more than AMD earned for the whole year 2016. The company’s gross profit for the quarter totalled $2.086 billion, whereas its net income hit $923 million, up from $320 million in the same period a year ago. AMD’s gross margin remained at 48%, whereas earnings per share reached $0.75.

“AMD had another record quarter as revenue grew 54% and operating income doubled year-over-year,” said Dr. Lisa Su, AMD president and CEO. “3rd Gen Epyc processor shipments ramped significantly in the quarter as our data center sales more than doubled year-over-year. Our business significantly accelerated in 2021, growing faster than the market based on our leadership products and consistent execution.”

AMD’s cash, cash equivalents and short-term investments were $3.608 billion at the end of the quarter, up $1.837 billion YoY. With plenty of cash in its pockets, AMD can invest in securing additional production capacities to support its long-term growth. In particular, the company has been investing in packaging and testing facilities as they are among the key bottlenecks for the semiconductor industry these days.

Speaking of bottlenecks, it is noteworthy that AMD’s inventories in as of the end of Q3 were worth $1.902 billion, which is a result of improved supply by AMD’s partners and perhaps a mix of more expensive products.

“Our supply chain team has executed extremely well in a challenging environment delivering incremental supplies throughout the year, supporting our strong revenue,” said chief executive of AMD. “We are also investing significantly to secure additional capacity to support our long-term growth.”

Compute & Graphics Business

AMD has complained that it cannot meet demand for all of its products due to production constraints at subcontractors. As a result, the company has to focus on producing and supplying higher-end parts, such as premium APUs and CPUs for commercial, gaming, and workstation machines.

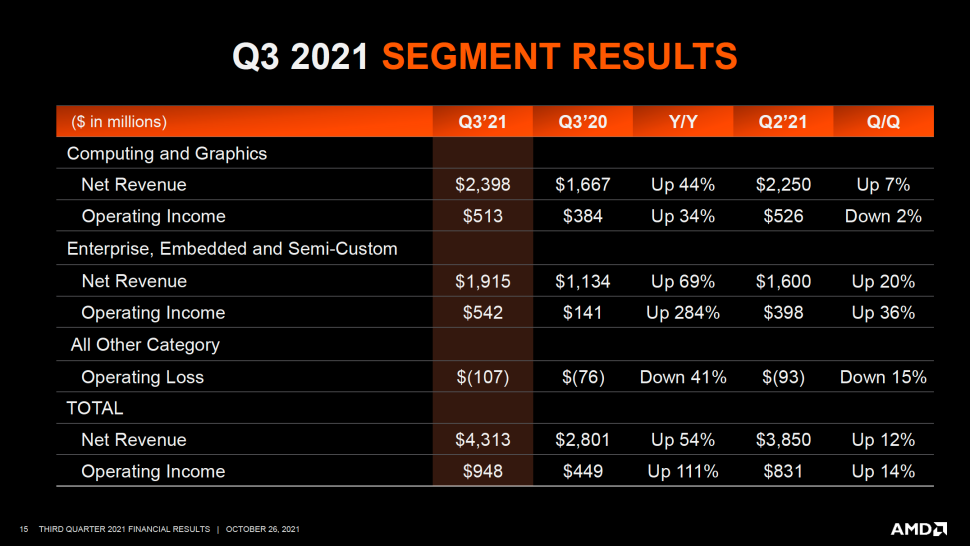

Such policy bore fruit in Q3 2021 as the company’s C&G business unit earned $2.398 billion net revenue (up 44% YoY) as well as $513 million net income (up 34% YoY). AMD specifically noted that during the quarter it sold plenty of Ryzen Threadripper Pro CPUs for workstations thanks to their unique combination of core count, memory support, and the number of PCIe lanes.

“We are also seeing strong growth in the workstation,” said Su. “According to IDC, Ryzen Threadripper Pro processors now power the best-selling workstations in their category in both North America and EMEA.”

AMD also shipped its next-generation Instinct MI200-series compute GPUs set to be installed into the upcoming Frontier exascale supercomputer.

“Datacenter graphics revenue more than doubled year-over-year and quarter-over-quarter led by shipments of our new AMD CDNA2 GPUs for their Frontier,” said Lisa Su.

Workstation CPUs and datacenter GPUs are expensive and are sold with a huge premium, so AMD significantly increased ASPs and reached record profitability for its C&G segment. Meanwhile, AMD admits that sales of its datacenter GPUs in Q4 will be down sequentially as there are no more large customers to adopt CDNA 2 GPUs just now

AMD’s management also said that it increased unit shipments of its Radeon RX 6000-series GPUs in Q3 (something that we will have to verify with independent analysts), which also contributed to growing sales and higher ASPs (compared to both Q2 2021 and Q3 2020). In past few weeks AMD’s top-of-the-range Radeon RX 6900 XT and enthusiast-grade Radeon RX 6800 XT became widely available from big retailers (albeit at high prices), so indeed it looks like AMD is increasing shipments of its GPUs.

“Our RDNA 2 GPU sales grew significantly in the quarter,” said the head of AMD. “As we ramped production and expanded our-top-to-bottom portfolio with the launch of the midrange Radeon RX 6600 XT cards […].”

Enterprise, Embedded & Semi-Custom Business

AMD’s Enterprise, Embedded, and Semi-Custom business unit earned $1.915 billion revenue in the third quarter, an increase of 69% YoY, and a 20% growth QoQ. Operating income of the BU reached $542 million, up a whopping 284% compared to the same period a year ago and a 36% increase sequentially.

During the quarter, shipments of AMD’s 3rd generation Epyc processors exceeded sales of the company’s 2nd generation Epyc CPUs, which clearly had a positive impact on the company’s average selling prices (ASPs) and profitability. To date, AMD’s partners have developed more than 100 server designs based on the 3rd Gen Epyc CPUs and as these designs ramp, shipments of the processors will continue to increase.

“3rd Gen Epyc processors continue ramping faster than the prior generation and contributed the majority of our servers CPU revenue in the quarter,” said chief executive of AMD. “In cloud, multiple hyperscalers expanded their 3rd Gen Epyc processor deployments to power their internal workloads and both Microsoft Azure and Google announced multiple new AMD-powered instances. CloudFlare, Vimeo, and Netflix all recently announced new deployments powered by Epyc processors with Netflix highlighting how they doubled their streaming throughput per server, while also reducing their TCO.”

Microsoft and Sony traditionally buy the highest number of SoCs for their consoles in Q3 in a bid to prepare for the holiday season. As a result, AMD’s EESC unit was boosted surging demand for servers, growing adoption of its latest Epyc 7003-series CPUs, and seasonality that favors game consoles.

It is interesting to note that AMD expects its console business to increase further in the fourth quarter, a rather unprecedented turn of events, which will further contribute to EESC’s growth in Q4.

Outlook

With demand for PCs, servers, and consoles remaining strong and supply situation improving, AMD is very optimistic about its prospects for the fourth quarter. The company expects its revenue to increase to $4.5 billion ±$100 million, an increase of about 39% compared to Q4 2020 and a 4% increase quarter-over-quarter. AMD attributes its growth in Q3 to surging demand for Epyc processors as well as console SoCs. The company also projects its non-GAAP gross margin to be 49.5% in Q4 2021.

AMD expects its revenue for the year to be roughly 65% higher compared to prior year and set another all-time record.