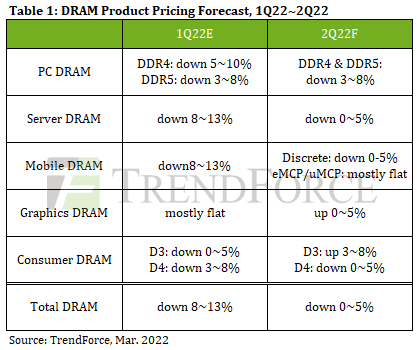

The average selling prices for DRAM are forecasted to drop by up to 5% in the second quarter because hardware manufacturers have built up enough inventory and because demand for PCs and other devices is not expected to be strong in the period due to uncertainties caused by Russian-Ukrainian war, according to TrendForce.

PC makers are adopting conservative DRAM stockpiling strategies for Q2 2022 as they have memory in stock. In addition, DRAM makers are ramping up production of higher density chips, thus increasing bit supply, and there are uncertainties with demand for PCs later this year. Normally, computer makers begin to stockpile DRAMs for the peak back-to-school season in June, but with uncertainties about the demand for PCs, they are not going to significantly increase their purchases, which is why PC DRAM prices are going to drop by 5% to 8%, TrendForce believes.

As far as server DRAM is concerned, inventory levels currently held by cloud service providers as well as server makers are significant enough and will remain at the same levels as Q1 2022 for the next quarter, which will cause prices to decline by up to 5% in the second quarter despite strong demand for servers these days.

When it comes to mobile DRAM, demand for smartphone memory (which is also used for notebooks and tablets) is expected to remain flat in the second quarter, which is why TrendForce believes that prices of LPDDR memory my decline by up to 5% in Q2 2022 when compared to Q1 2022. This is somewhat surprising as Apple and its partners typically begin stockpiling LPDDR memory for its next-generation iPhones and increased demand for laptops in May to June timeframe, which naturally stimulates price growth.

For those readers looking forward to buying a new graphics card in the coming months, it will certainly be not-so-pleasant to know graphics memory prices are projected to increase by up to 5% in the second quarter. TrendForce explains that GDDR6 price drops in the recent months were caused by “weak virtual currency prices in recent months,” but it says that they will not stay flat in Q2 because Micron is expected to cease shipments of 8Gb GDDR6 memory chips used by various graphics cards, which will affect prices such ICs and boards.

While the adoption of DDR5 SDRAM is gradually increasing, there are plenty of applications like Wi-Fi 6 routers that use not only DDR4, but even DDR3. Major DRAM makers have been winding down DDR3 production for years; its price is expected to increase by 3% to 8% in Q2 2022. However, DDR4 pricing is projected to decrease by up to 5%.

In general, uncertainties with PC and DRAM demand will affect computer memory prices and DRAM manufacturer profitability. But since nobody knows how long the war between Russia and Ukraine will last and how it will affect the DRAM supply chain, it is hard to predict DRAM prices in the longer-term future.