AMD posts record $23.6 billion full year 2022 revenue.

AMD published its financial results for the fourth quarter and full year of 2022. Due to strong demand for AMD’s data center EPYC processors, the company posted an all-time record revenue for the full year. Meanwhile, sales of consumer CPUs and GPUs declined significantly in the fourth quarter, which clearly limited the company’s growth in Q4.

Record Year, Not-So-Record Quarter

AMD’s Q4 2022 revenue totaled $5.6 billion, up 16% year-over-year and flat with Q4 2022. Meanwhile, the company’s net income collapsed to $21 million, 98% lower than in the same period a year ago. As for gross margin, it dropped to 43% from 50% in Q4 2021.

As for the full year 2022, AMD earned $23.601 billion, up a whopping 44% from $16.434 billion in 2021. This was the highest yearly result that AMD has ever posted, yet it could have been higher if demand for consumer processors and graphics cards had been stronger in the third and fourth quarters.

“2022 was a strong year for AMD as we delivered best-in-class growth and record revenue despite the weak PC environment in the second half of the year,” said AMD Chair and CEO Dr. Lisa Su. “We accelerated our data center momentum and closed our strategic acquisition of Xilinx, significantly diversifying our business and strengthening our financial model. Although the demand environment is mixed, we are confident in our ability to gain market share in 2023 and deliver long-term growth based on our differentiated product portfolio.”

Because of softening PC market, the year 2022 was somewhat of a mixed bag for AMD since demand for its products met expectations in the first half, but demand for consumer PC hardware dropped sharply in the second half, affecting the full-year results.

Data Center Hardware on the Rise, Consumer Hardware Sales Craters

Consumer CPUs and chipsets used to be AMD’s bread and butter some five or six years ago, but that is no longer true. In Q4, the revenue of AMD’s Client Computing Business dropped to $0.903 billion, or 51% year-over-year. The business unit lost $152 million, whereas in the same quarter a year before, it posted a $530 million profit.

Perhaps the most alarming detail about AMD’s consumer CPU business is that in a quarter when the company introduced its brand-new Ryzen 7000-series processors, the average selling prices of its CPUs were flat year-over-year, suggesting tepid sales of the latest parts.

When it comes to AMD’s Gaming Business, there was a mixed bag again. On the one hand, the unit earned $1.6 billion in revenue (down 7% year-over-year) and $266 million in profits (down from $407 million in Q4 2021). But on the other hand, this strong result was achieved primarily because AMD managed to sell loads of system-on-chips for consoles, whereas the sales of its graphics processors for discrete desktop PC GPUs were down year-over-year.

Having earned $1.7 billion in revenue, an increase of 42% year-over-year, AMD’s Datacenter Business was the main source of income for the company in Q4 2022, outstripping the Gaming and Embedded businesses. Despite lower margins (27% in Q4 2022 vs 32% in Q2 2022), the group’s operating income totaled $444 million, up from $369 million in the same period a year before.

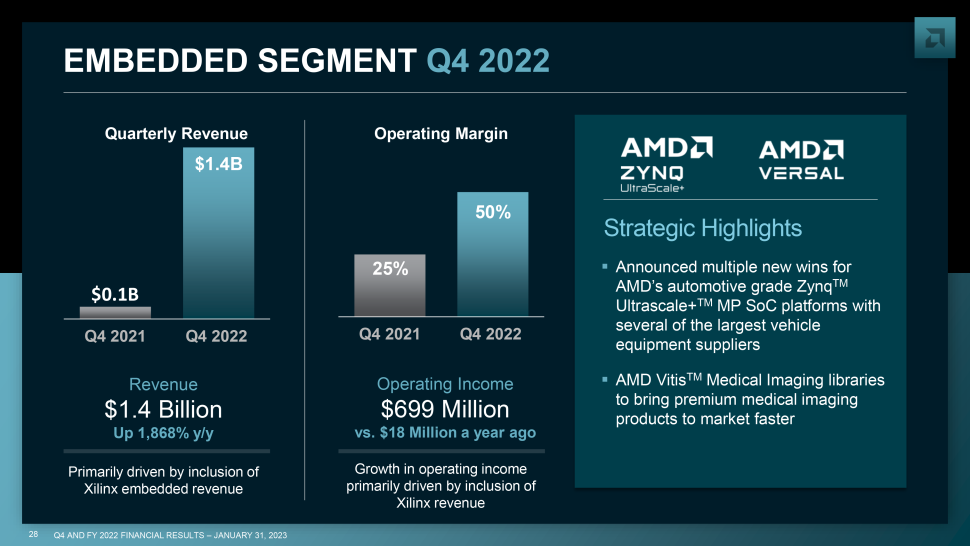

As for AMD’s Embedded Business — which mostly sells products designed by Xilinx and some chips designed by AMD — posted earnings of $1.4 billion and earned $699 million in profits, marking another bright spot in AMD’s financial report.

Cautious Outlook for Q1, Lack of Outlook for Whole 2023

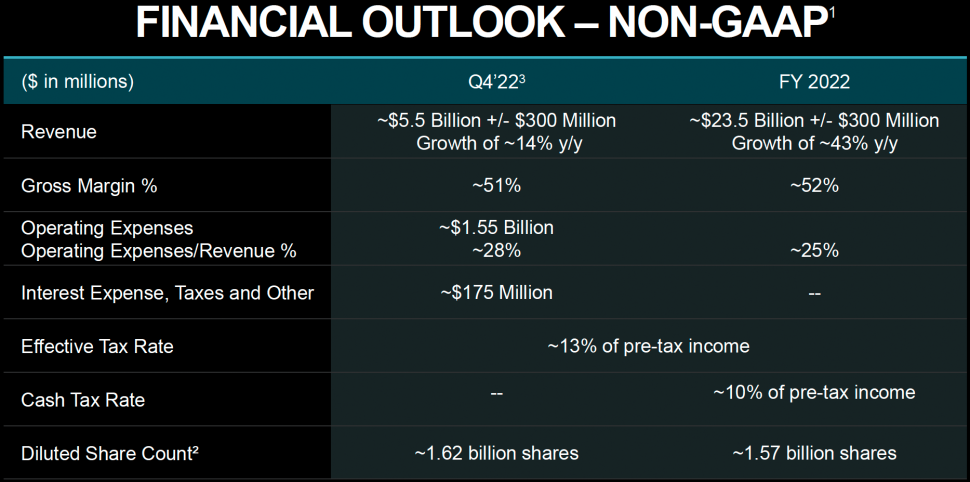

AMD expects its first-quarter revenue to be approximately $5.3 billion (±$300 million), a decline of about 10% YoY mainly because of lower consumer CPU and gaming GPU and SoCs sales. The company expects shipments of its data center solutions, such as EPYC CPUs and Pensando DPUs, FPGAs, and embedded products to continue increasing.

Meanwhile, just like some other high-tech companies, AMD didn’t provide an outlook for the whole year due to a lack of proper visibility for the second half of 2023.